Build escrow-based marketplaces where trust is enforced by software, not promises.

I build secure, escrow-based marketplace platforms where payments, delivery, and trust are enforced by software, not promises. Artificially creating a platform for honest transactions.

Who This Is For

Founders and operators building two-sided or multi-party marketplaces that require payment protection, milestone releases, or dispute control.

Marketplace Founders

Building platforms connecting buyers and sellers who need payment security and trust mechanisms.

Service Platform Operators

Creating platforms for high-value B2B services requiring milestone-based payments.

E-commerce Innovators

Launching social commerce or WhatsApp-based marketplaces needing escrow protection.

What "Escrow-Powered" Means

Funds are held securely and released only when predefined conditions are met, reducing fraud, chargebacks, and platform liability.

Secure Fund Holding

Payments are locked in escrow until delivery confirmation or milestone completion.

Conditional Release

Automated release based on predefined conditions - no manual intervention needed.

Built-In Trust

Both parties protected - sellers get paid, buyers receive what they ordered.

Problems This Solves

Stop payment disputes, build instant trust between users, and remove manual intervention from sensitive financial workflows.

Payment Disputes & Fraud

Chargebacks and "I didn't receive it" claims drain time and money

Escrow holds funds until proof of delivery, eliminating false claims

Trust Barrier

New users hesitate to transact on platforms without reputation

Built-in escrow creates instant trust - software guarantees fairness

Manual Intervention

Every dispute requires customer support to investigate and decide

Automated release logic based on milestones and confirmations

Platform Liability

You're held responsible when transactions go wrong

Clear fund separation and automated workflows reduce your risk exposure

Core Marketplace Features

User roles, wallets, escrow logic, milestone payouts, dispute flows, admin oversight, and full transaction visibility.

User Role Management

Buyers, sellers, service providers, and admins - each with appropriate permissions and workflows

Digital Wallets

In-platform wallets for deposits, withdrawals, and balance tracking with full transaction history

Escrow Logic Engine

Automated fund holding and release based on configurable conditions and confirmations

Milestone Payouts

Split payments across project phases with conditional release for each milestone

Dispute Workflows

Structured dispute submission, evidence upload, and resolution with time-based escalation

Admin Dashboard

Full platform oversight with transaction monitoring, dispute management, and analytics

Transaction Audit Logs

Immutable records of every transaction, state change, and fund movement

KYC/AML Integration

Identity verification and compliance checks before high-value transactions

Rating & Reviews

Post-transaction reviews and ratings to build seller reputation and buyer confidence

Payment & Compliance Architecture

Integration with compliant payment providers, KYC/AML considerations, audit logs, and region-aware payout flows.

Payment Providers

Stripe

Global payments with built-in fraud protection and compliance

PayStack

Optimized for African markets with local payment methods

Flutterwave

Pan-African payment infrastructure with mobile money support

Nomba (formerly Kudi)

Nigerian-focused payments with USSD and transfer options

Compliance & Security

KYC/AML Checks

Identity verification for high-value transactions and sellers

Audit Trails

Complete transaction logs for regulatory compliance and disputes

Fund Separation

Clear separation between platform revenue and user funds

Region-Aware Flows

Payout methods adapted to user location and currency

Dispute Resolution Flow

Structured dispute logic with evidence submission, time-based escalation, and controlled fund release decisions.

Dispute Initiation

Either party can open a dispute within a defined window (e.g., 7 days after delivery). Funds remain locked in escrow during investigation.

Evidence Submission

Both parties upload evidence (photos, messages, delivery confirmations). All submissions are timestamped and logged for transparency.

Time-Based Escalation

If no response within 48 hours, case auto-escalates to admin review. Prevents one party from stalling the process indefinitely.

Admin Decision

Platform admin reviews evidence and makes final decision: full refund, full release, or partial split based on findings.

Controlled Fund Release

Funds are released according to admin decision. Both parties are notified. Transaction is marked complete with resolution details in audit log.

Technology Stack

Modern, scalable stack designed for high-trust financial systems.

Backend

High-performance async framework for financial APIs

ACID-compliant transactions for financial integrity

Real-time data caching and session management

Background tasks for escrow logic and notifications

Frontend

Server-side rendering for SEO and performance

Type-safe development to prevent runtime errors

Rapid UI development with consistent design

Live transaction updates and notifications

Infrastructure & Security

Security & Risk Posture

Built with least-privilege access, tamper-resistant records, and clear separation between platform funds and user balances.

Least-Privilege Access

Users and admins only access what they need. No one - including you - can arbitrarily move funds outside defined workflows.

Tamper-Resistant Records

All transactions are logged immutably. Audit trails cannot be edited or deleted, ensuring transparency and accountability.

Fund Separation

Platform revenue (fees) kept separate from user escrow balances. Clear accounting prevents commingling of funds.

Encryption at Rest & Transit

All sensitive data encrypted using industry-standard protocols. Payment credentials never stored directly.

Transaction Monitoring

Real-time fraud detection and anomaly alerts. Suspicious patterns flagged for review before fund release.

Compliance-Ready

Built with KYC/AML requirements in mind. Easy to add compliance checks as you scale to new regions.

Example Use Cases

From freelance marketplaces to social commerce, escrow powers trust in diverse transaction types.

Freelance Marketplaces

Connect clients with freelancers. Funds held until work is approved, with milestone releases for larger projects.

- Project-based escrow

- Milestone payments

- Revision workflows

WhatsApp Marketplaces

Social commerce on WhatsApp with escrow backend. Buyers pay to platform, sellers ship, funds release on delivery.

- Chat-based ordering

- Delivery confirmation

- Seller verification

Service Platforms

Handyman, teachers, tutors, job-seeking platforms. Escrow ensures payment for completed services.

- Booking & escrow

- Service completion check

- Rating system

Digital Asset Exchanges

Trade digital assets, domains, or licenses. Escrow prevents scams and ensures both parties fulfill obligations.

- Asset transfer verification

- Ownership proof

- Automated release

Teacher & School Platforms

Connect students with tutors or schools. Payment held until course completion or attendance verified.

- Course enrollment

- Progress tracking

- Completion-based release

High-Value B2B Services

Consulting, construction, enterprise software delivery. Milestone escrow for projects spanning months.

- Multi-milestone contracts

- Deliverable verification

- Change order handling

Engagement Model

End-to-end build or technical co-founder style execution, from system design to production-ready deployment.

End-to-End Build

I handle the complete development lifecycle - from architecture design through deployment and handoff.

System Architecture

Database schema, API design, escrow logic flows

Full-Stack Development

Backend APIs, admin dashboard, user interface

Production Deployment

Server setup, CI/CD, monitoring, documentation

Technical Co-Founder

Ongoing partnership where I act as your technical co-founder, building and evolving the platform with you.

Strategic Planning

Feature prioritization, technical roadmap, scaling strategy

Iterative Development

Launch MVP, gather feedback, add features based on usage

Ongoing Optimization

Performance tuning, security updates, new integrations

Typical Timeline

Week 1-2

Discovery, architecture design, escrow flow mapping

Week 3-6

Core development: user auth, wallets, escrow engine, admin panel

Week 7-8

Payment integration, testing, deployment, handoff documentation

Why Work With Me

You're working directly with the builder designing the system logic, not a sales layer or outsourced team guessing requirements.

No Middlemen

You communicate directly with the person writing the code. No project managers translating your requirements incorrectly.

Financial Systems Experience

I've built payment systems and financial platforms. I understand the stakes when money is involved.

Startup Speed

One of the startups I launched made over $20,000 in its first 9 months. I build fast and ship to real users.

Full Transparency

You see the code as it's written. You own everything - no vendor lock-in, no proprietary black boxes.

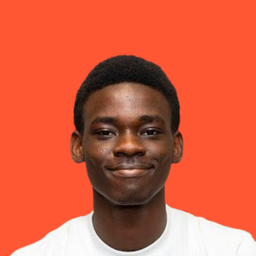

Tomilola Oluwafemi

Nigeria's Top-Rated Software Developer

Let's Discuss Your Marketplace

Tell me about your marketplace model, escrow flow requirements, and risk profile. I'll provide a technical approach and timeline - before any code is written.

No obligation. Just a conversation about what you're building.

Amazing Testimonials

Emmanuel Ajayi

Snr Marketer at Wakanow

Our old website at CNGExpert was losing us customers - bounce rate was 78% and we hadn't gotten a single inquiry in 3 months. After Tomilola rebuilt our site, bounce rate dropped to 32% and we closed 4 new contracts worth $85K in the first 6 weeks.